(H)AMERICAN

ROYALTY

Gallery8 times Queen Mary channeled Princess Kate: from bouncy blow-drys to rule-breaking manicures

King Frederik's wife has been getting Kate-coded in her recent looksFASHION

Sarah Jessica Parker just made this UK fashion brand go viral in under an hour

And Just Like That, SJP causes a sellout…

Harper Beckham, 12, is mum Victoria's actual lookalike in £300 floral dress

David Beckham's daughter is so chic - just like VB

Sasha Obama puts statuesque physique on display in midriff-baring outfit - and you should see her nails

Sasha is the youngest daughter of Barack and Michelle Obama

I searched Cupshe's trending swimsuits for the most flattering - these are my picks for summer

Get ready to stock up...

POP CULTURE

Amanda Owen's son Reuben shares reaction parents shock divorce

The Our Yorkshire Farm star is about to embark on his own new TV show….TV AND FILM

HAPPINESS

More HappinessPODCASTS

Podcast ArticleScoop's Sam McAlister reveals why she never asked the royal family for permission to write about Prince Andrew's interview

The former Newsnight producer and guest booker, who is portrayed by Billie Piper in the Netflix hit, reveals allFAMILIES

Celine Dion's 'introverted' son René-Charles' selfless act revealed: 'He did it for his mother'

Celine shares three sons with late husband René AngélilTRENDING

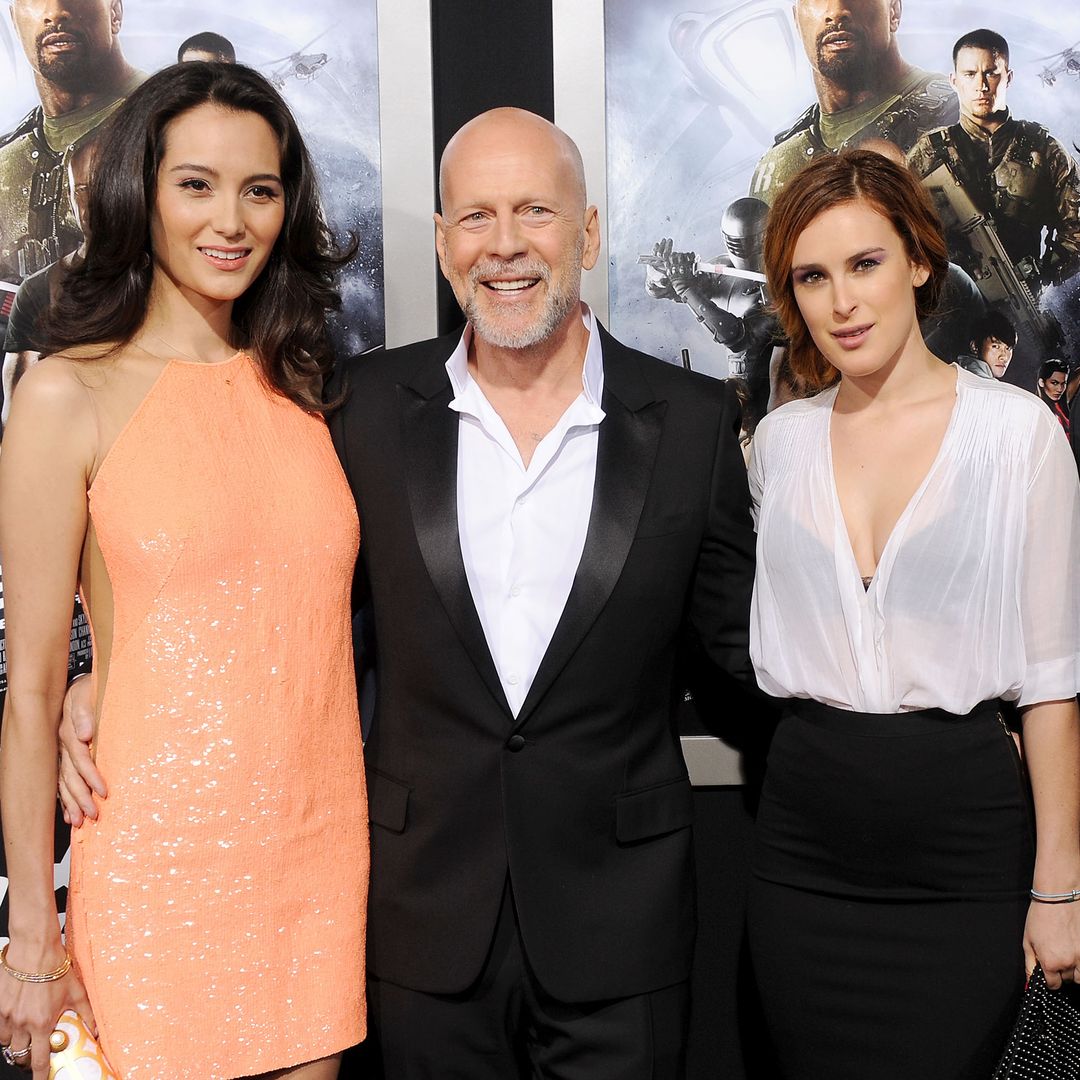

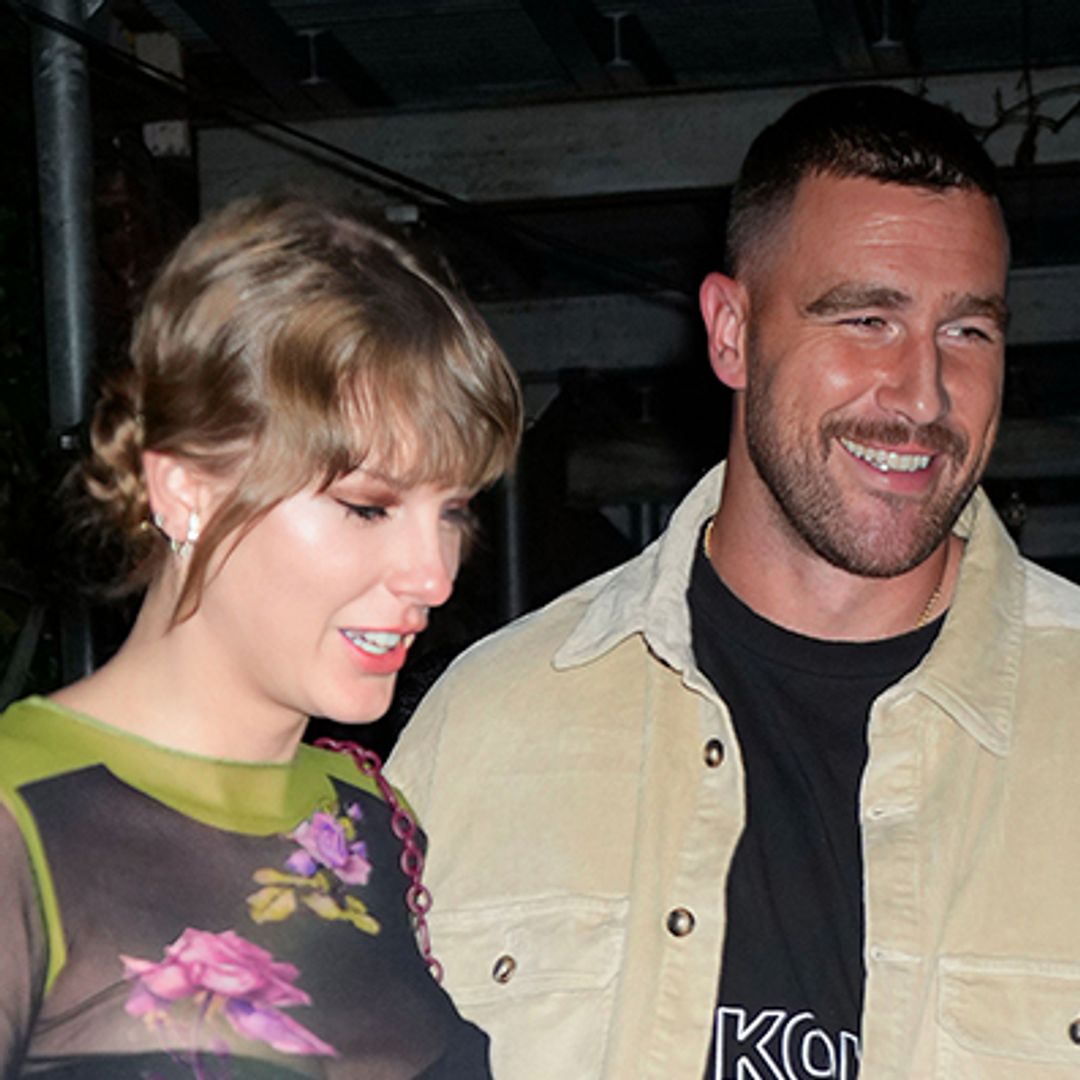

A Long List of Ex-Lovers

GalleryTaylor Swift's very public dating history: a timeline of her famous partners

WEDDINGS

Weddings

I’m a control freak but I am letting AI plan my wedding

Self-confessed task master, Daria Martorana, 28, explains why she is relinquishing control for her special dayDWTS

LATEST

Beauty

Exclusive: Emma Willis shares her beauty secrets and how to feel confident in your own skin

In partnership with Absolute Collagen

Celebrity News