Special day

STAR REELS

ROYALTY

Prince Louis' sixth birthday photo has got royal fans all saying the same thing

The Princess of Wales got behind the camera to take the sweet snap of her sonFASHION

12 cut-out dresses to shop if Meghan Markle made you want one

Coveted cut-out dresses to shop now for summer

Gallery40 Best dressed celebrities in April 2024: Zendaya, Victoria Beckham, Alicia Keys, and more

Coachella is sure to bring a flurry of enviable looks from the style set this month

9 blue & white striped shirts you’ll repeat-wear throughout 2024

It'll soon become the most worn piece in your wardrobe

The best new season denim skirts to shop now

A denim skirt will slot seamlessly into your spring/summer wardrobe

POP CULTURE

Beyoncé's best hair transformations through the years in photos

The "TEXAS HOLD 'EM" singer recently highlighted her natural hair while promoting her new brand CécredTV AND FILM

HAPPINESS

More HappinessPODCASTS

Podcast ArticleScoop's Sam McAlister reveals why she never asked the royal family for permission to write about Prince Andrew's interview

The former Newsnight producer and guest booker, who is portrayed by Billie Piper in the Netflix hit, reveals allFAMILIES

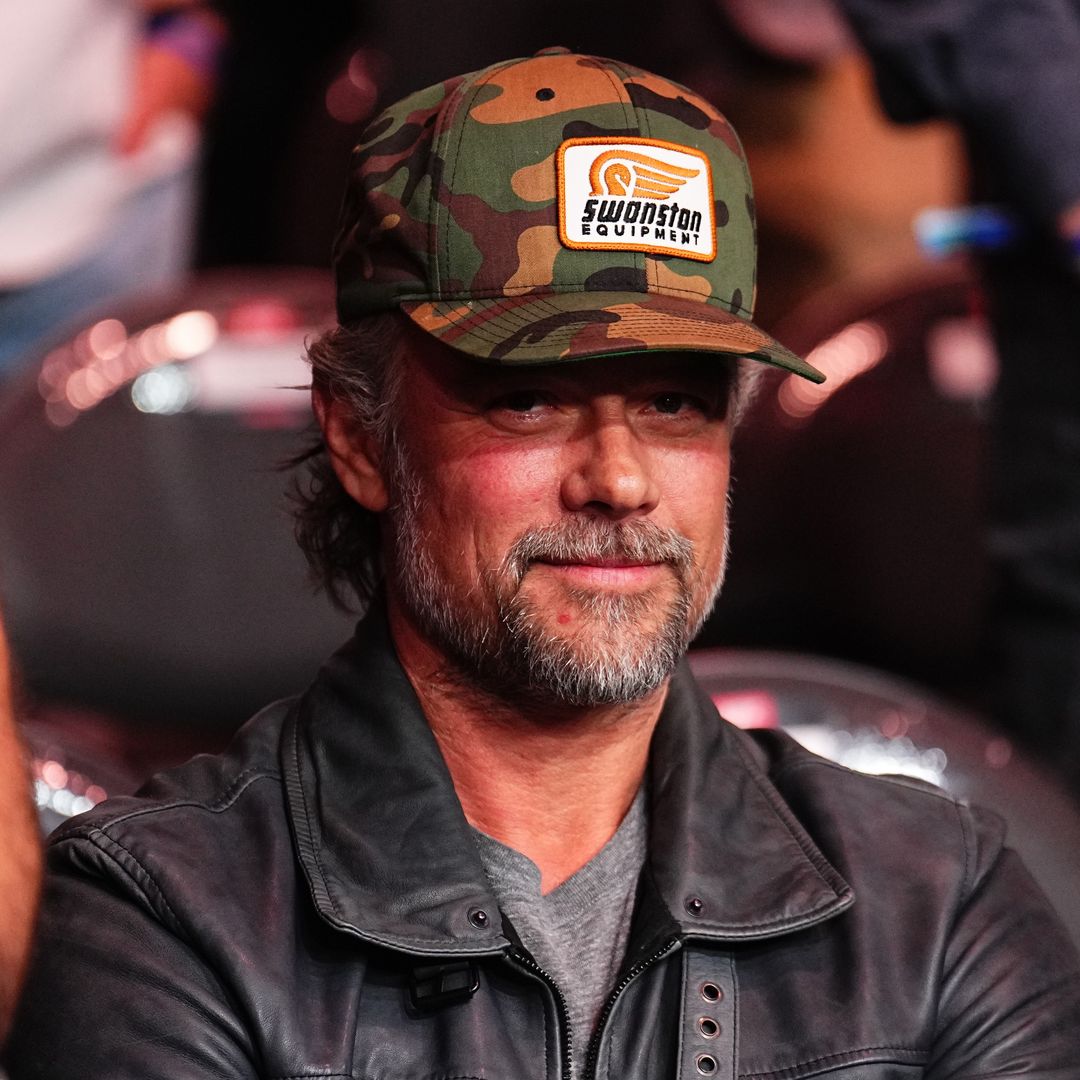

Ricky Martin's twin sons, 15, look so grown up in new family vacation photo

The Palm Royale star shares four children with ex-husband Jwan YosefTRENDING

WEDDINGS

Weddings

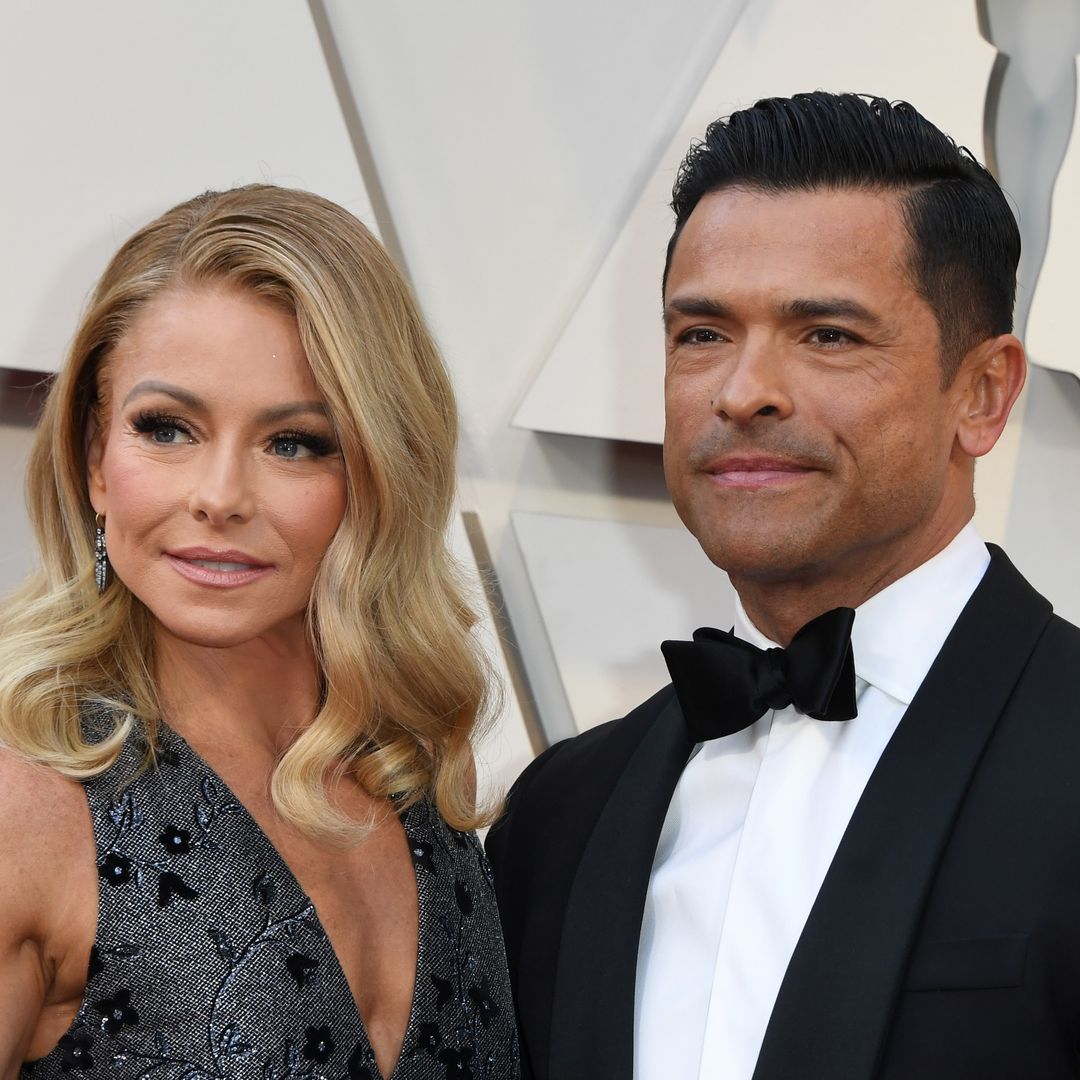

Kelly Ripa, 53, sizzles in sequins in most show-stopping wedding guest dress to date

The Live! with Kelly and Mark star looked glamorous alongside her husband Mark ConsuelosLATEST