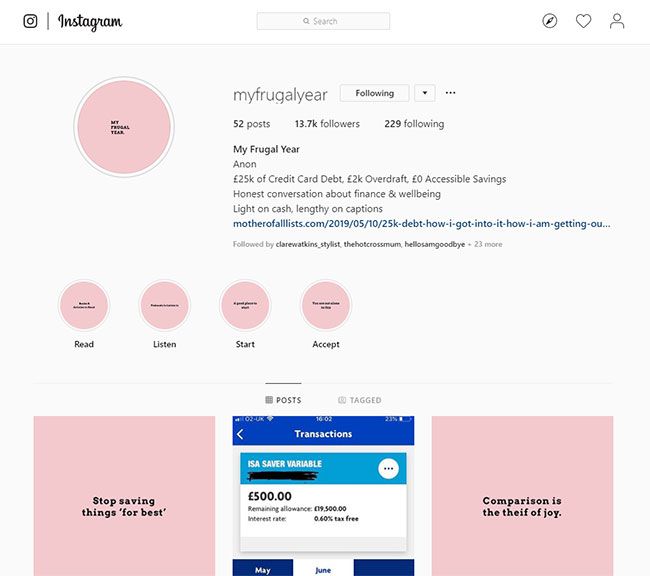

MyFrugalYear is the anonymous instagram account who has broken all the rules to talk candidly about money. About how much she's spent and how much she really regrets spending it. The mum-of-two will be revealing a weekly diary here on HELLOMAGAZINE.COM, detailing her battle with debt and sharing tips on how she's reducing it.

The intro

I can’t tell you my name, but I’m about to tell you how much debt I have. It’s not the most important or even most interesting thing about me, but it is the reason I’m here, writing to you. I owe £25,000 on credit cards... £5k on Amex, £10k on Barclaycard to name a few, as well as £2,000 on my overdraft. I’ve always been terrible with money - my propensity to underestimate the cost of everything, coupled with a natural reluctance to face problems, means that I’ve consistently lived beyond my means, never fully understanding where I was going wrong, or realising that I was headed for a very big fall. That fall came three months ago...

I was on the phone to a financial advisor at my bank, who was asking me why I remained in an unarranged overdraft after several notifications. "I just…" I stuttered, knowing what I had to say but struggling, "there’s no more money left." I looked around me, trying to identify where it had all gone. A half dead fiddle leaf fig in a Moroccan style basket. A Hague Blue feature wall. The same two Desenio prints as any given interiors instagrammer.

It was mid-month and pay day wasn’t even on the horizon, but the crippling minimum repayments for several maxed out credit cards plus childcare costs, rent and bills on only one full salary meant that there was nothing left to transfer, no savings to come to the rescue. I’d used all my nine lives. Now there was nothing left to do but face the consequences of too many spontaneous purchases, too much keeping up appearances, too much doing it for the ‘gram. It was terrifying, but I finally took a deep breath and totted up the grand total.

You might wonder, how does one get to £27k in the red without taking note? The answer is that for me, it was easy, like living on autopilot. Like, when you arrive at work but don't remember how, ignoring all the near misses you might have had. I kept getting approved for credit cards, kept having my limits automatically increased. The frequent ‘oh ***t’ moments were easy to ignore, shrouded by my latest Jo Malone perfume… Until they weren’t. The weight of them hit me all at once, as I struggled to keep tears back on that phone call.

That day, I started My Frugal Year, an Instagram account that I hoped might help me to take control of my finances. I had some vague idea that my followers might shout at me if I spent too much, and I found poetry in using the platform that had, for so long, kept me spending, to help me dig myself out again.

I didn’t expect what happened next. The catharsis of admitting it out loud. The outpouring of empathy from hundreds of people who were in a similar situation, most of them also haunted by the ghost of a trendy carpet whose credit card legacy had outlived it. I realised that what I was saying resonated with people, not only because nobody else was saying it, but because if I refused to let my debt define me, it meant that theirs didn’t define them, either. #iamnotmydebt

Three tips for taking hold of your finances

1) Arm yourself with the information. Unsquint your eyes at the cash point, check your credit score and audit your outgoings.

2) If you’re having a rough time financially, confide in someone. It’s the first step to ridding yourself of that unhelpful emotion, shame.

3) Make a plan. Download an app like Money Dashboard, or scribble it all down in a fancy-pants notebook.

Next week MyFrugalYear shares her top tips on how to avoid the secret tricks used to get you to part with your hard earned cash.