Must-See Photos

STAR REELS

ROYALTY

Princess Beatrice dazzles in figure-skimming satin wrap dress

Princess Eugenie's sister flew solo for an outing in DubaiFASHION

12 denim shirts to embrace the double denim look

Double denim is going nowhere, so snap up a denim shirt to try out one of fashion's divisive trends

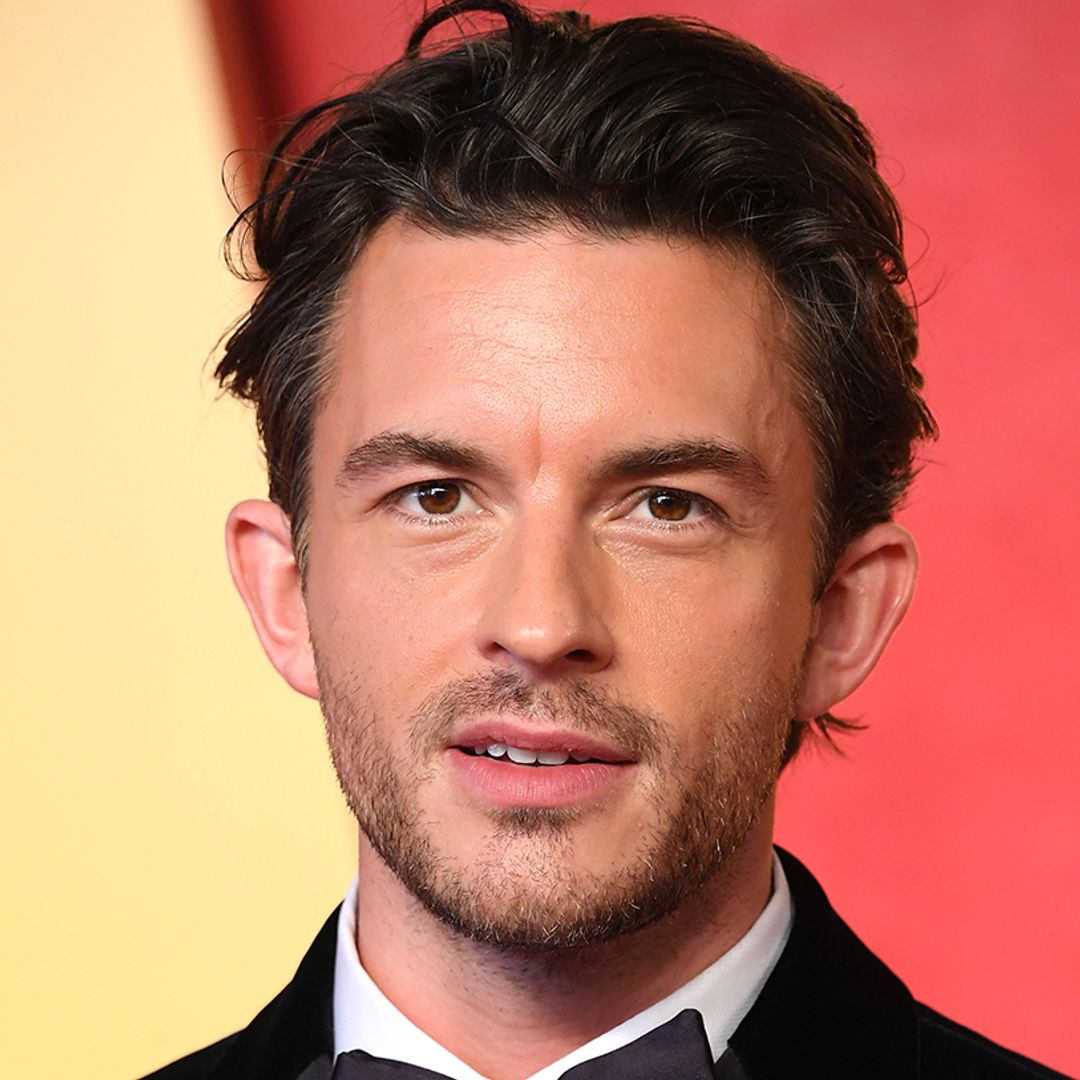

Blue Bloods' Bridget Moynahan gives Gisele a run for her money in throwback modeling photos

The actress was a model before she found fame on Sex and the City

Zendaya just copied Kylie Minogue's most iconic outfit

The actress looked like she had stepped out of a 2001 music video

Whenever I wear Mint Velvet I get nothing but compliments - here's what I'm buying for my spring wardrobe

Mint Velvet is my go-to for new looks…

POP CULTURE

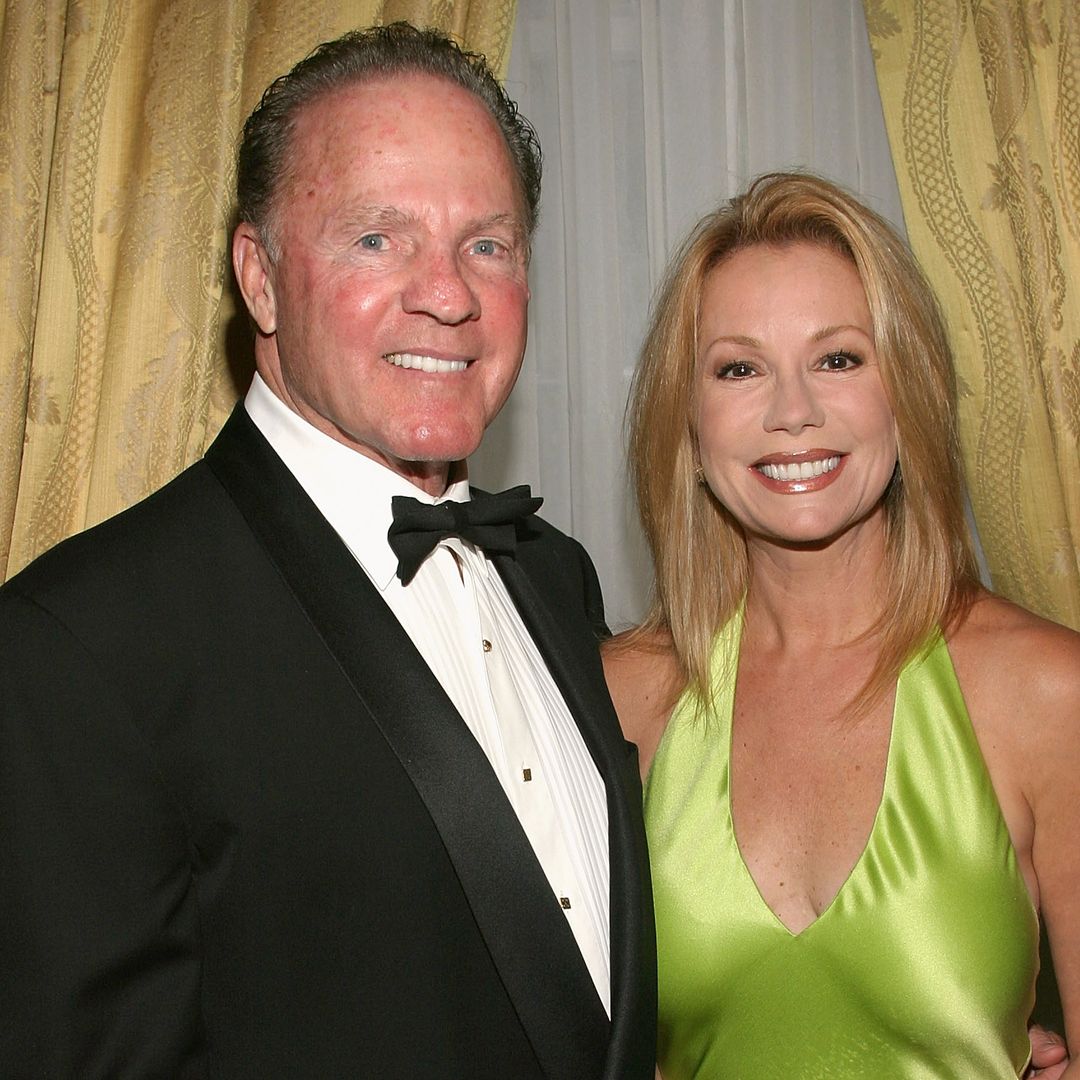

Andy Murray and wife Kim cuddle up in rare photo ahead of big milestone

The couple recently celebrated their 9th wedding anniversaryTV AND FILM

HAPPINESS

More HappinessPODCASTS

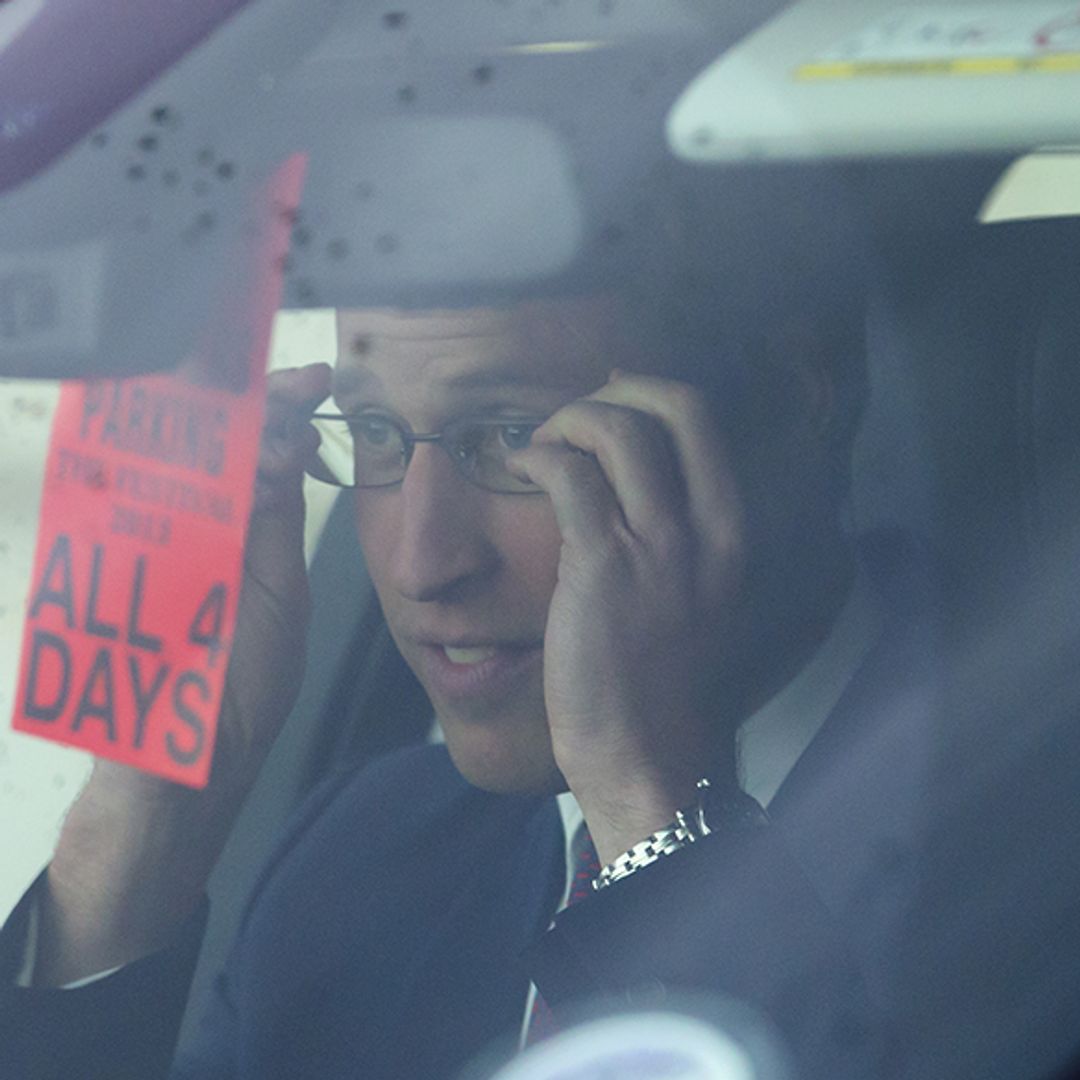

Podcast ArticleScoop's Sam McAlister reveals why she never asked the royal family for permission to write about Prince Andrew's interview

The former Newsnight producer and guest booker, who is portrayed by Billie Piper in the Netflix hit, reveals allFAMILIES

Jennifer Garner's fans gush over her sweet gesture for child Fin — see intimate glimpse into family life

The 13 Going on 30 actress shares three children with ex-husband Ben AffleckWEDDINGS

Weddings

Meghan Markle's secret engagement ring 'tweak' is highly unlikely

The Duchess of Sussex's engagement ring includes very sentimental diamonds from Prince HarryLATEST