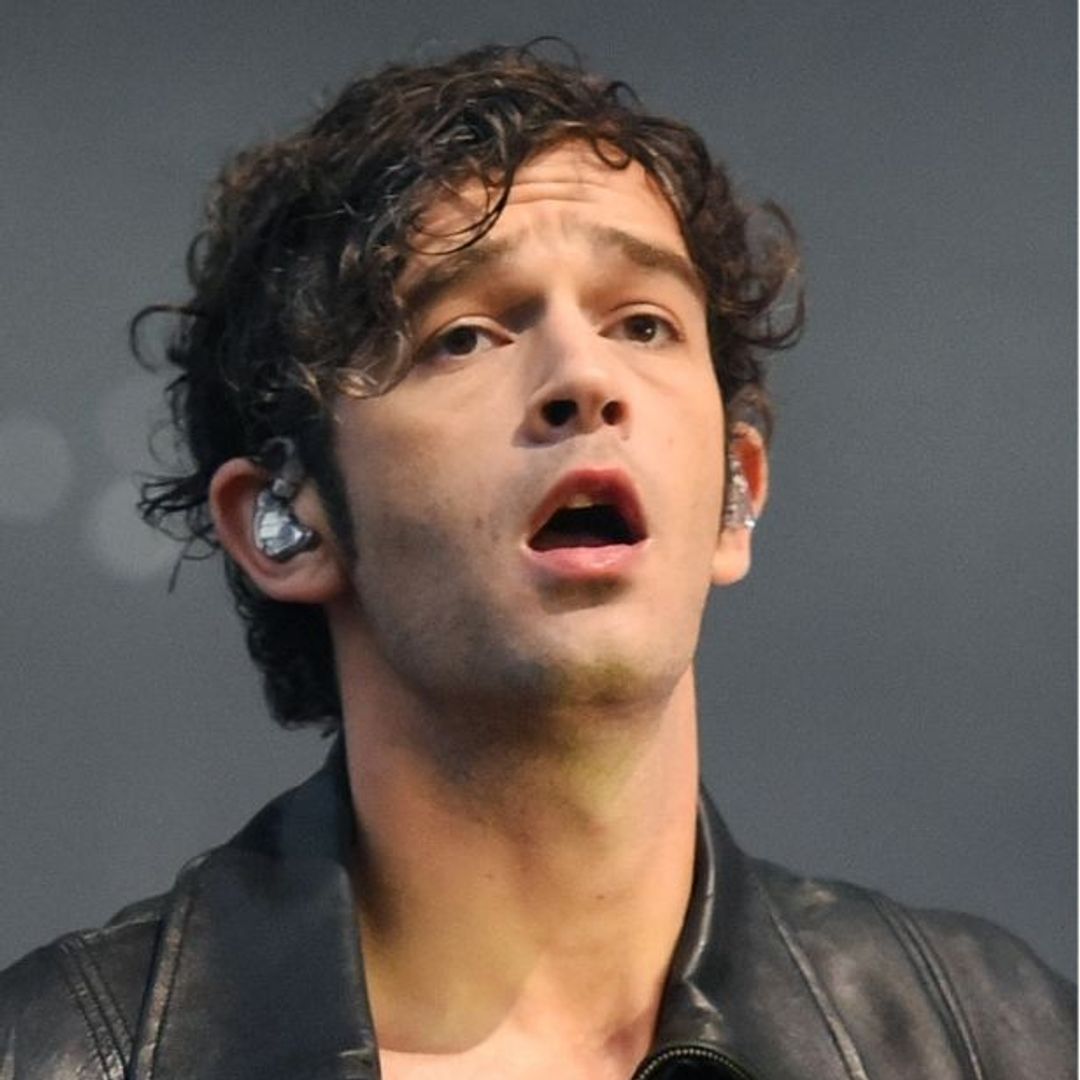

Martin Lewis, 51, has issued a cautious message with regards to the new 100% mortgages that require no deposit whatsoever.

This particular mortgage option, which has been very popular in the past, is now back and it has been designed to help renters who are unable to save up for a deposit to own their own home.

Money expert and Good Morning Britain star Martin has published a blog post on his website, explaining that he "cautiously" welcomes the new addition to the market.

He penned: "Having campaigned for years to try and help mortgage prisoners locked in at hideous unaffordable rates – the spectre of 100% mortgages returning leaves me with mixed feelings.

"Years of property-porn TV shows have spouted the idea that you must buy a house as soon as possible, as big as possible – actually, the real priority is not to over-stretch your finances. Before the 2007 financial crash, banks would simply throw mortgage loans out to anyone walking past a branch window; now we need to be more careful.

"So Skipton Building Society's criteria of requiring a good rental track record to prove someone can make mortgage payments is sensible, and so I cautiously welcome it, done carefully after advice, as an option for some."

How do 100% mortgages work?

Skipton Building Society is the first lender to offer this type of mortgage in recent years, so how does it work?

They have called it a "track record mortgage" as the principle is that providing your track record of paying rent will help the lender trust to lend you money. The mortgage is a five-year fixed term mortgage and the amount you are able to borrow is dictated by how much rent you have been paying. For example, if you've paid £1,000 per month rent, you are likely to be able to borrow £186, 442 and if you've forked out £1,500 for rent you can perhaps secure a mortgage of £279,662.

REVEALED: How to add £15k to your home's value in 24 hours

Who isn't eligible for a 100% mortgage?

- If you can't provide proof of paying rent for the past 12 consecutive months

- If you can't provide proof of paying all household bills for the past 12 consecutive months

- If you want to buy a new-build flat

- If you've missed payments in the last six months

What are other financial experts saying about 100% mortgages?

David Hannah, Group Chairman of Cornerstone Tax thinks the move is a good thing. He notes: "Whilst there are some concerns about this type of mortgage given what happened in the 2008 financial crash, I believe that a lot has been learned since then and affordability tests will be thorough. I also think that the risk of falling into negative equity may only be present for some who buy and sell quickly afterwards – new homeowners that hang onto this home for a number of years should see their asset increase in value."

Simon Bath, CEO and founder of iPlace Global has said: "The huge increase in inflation - most notably on mortgage interest rates which we saw at the end of 2022 - has had a detrimental effect on a generation of first-time buyers in terms of their ability to get on the property ladder… I believe that if house price growth continues to slow, and those in generation rent are able to meet the requirements for the track-free mortgage, we may see a big wave of first-time buyers entering the market."

READ: 28 easy tricks to make your home sell fast without spending a penny

Interestingly, research from the Gradual Homeownership provider, Wayhome, has discovered that people may be reluctant to take up the new scheme. They reported: "Just 26% stated that they would have considered a 100% mortgage when looking to buy their current property. Just 21% also stated that they would be prepared to pay a higher monthly mortgage repayment simply to secure a 100% mortgage."

Want to keep up to date with the latest stories?Sign up to our HELLO! Newsletters today.